Abolish Gasoline Sales Tax

BALLOT

NTATIVE

^ABOLISH Gasoline

SALES TA^

11436 OLD RIVER SCHOOL ROAD,DOWNEY.CALIFORNIA 90241

(213)928-2541

1

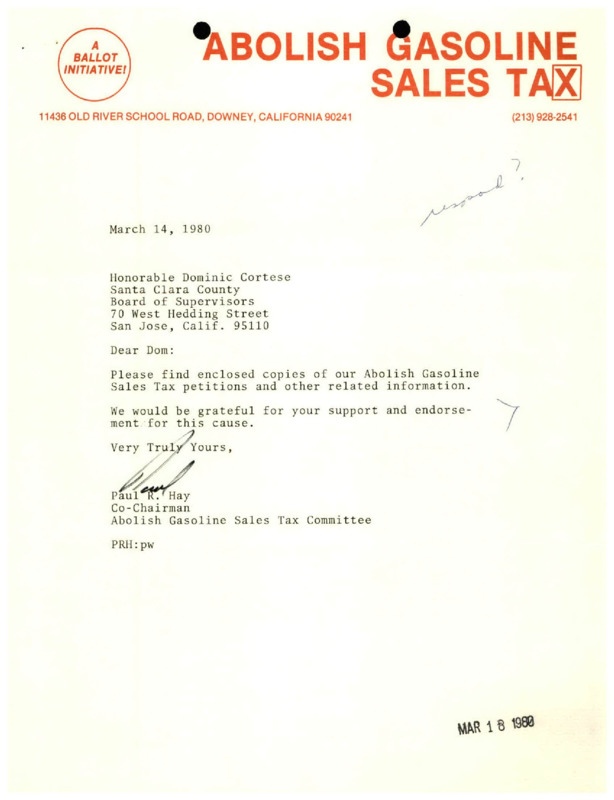

March 14, 1980

Honorable Dominic Cortese

Santa Clara County

Board o£ Supervisors

70 West Hedding Street

San Jose, Calif. 95110

Dear Dom:

Please find enclosed copies of our Abolish Gasoline

Sales Tax petitions and other related information.

We would be grateful for your support and endorse

ment for this cause.

Very Truibr Yours,

Paul IT.'Hay

Co-Chairman

Abolish Gasoline Sales Tax Committee

PRH:pw

ABOLISH GASOLINE

BALLOT

INITIATIVE!

rm

11436 OLD RIVER SCHOOL ROAD, DOWNEY, CALIFORNIA 90241

(213)928-2541

FACT SHEET

Why Abolish Gasoline Sales Tax?

Regressive Tax.

Because sales tax is based on a percentage, it is

regressive and hurts most of those who can least afford to pay

it.

It is unrelated in any way to the ability to pay.

Inflationary Tax.

Because of OPEC price increases, gasoline sales

tax has increased at a rate 3 times that of the national infla

tion rate.

1979 inflation was 15.3^.

Gasoline sales tax

increased nearly 401.

Tax on Tax. Because federal (4^3 and state (Tif) excise taxes are

added to the cost before sales tax is collected, consumers are

p-aying tax on tax.

Undisclosed Tax.

While sales tax on all other taxable products is

shown separately from the product cost, California law requires

gasoline sales tax to be burried in the retail price. Many

motorists have been unaware they are paying sales tax on gasoline.

Essential Commodity Tax.

as is food.

Gasoline is an essential commodity just

Sales tax is not charged on other essential commod

ities, so why is it charged on gasoline?

Windfall Tax.

gallon.

In 1972 the approximate tax on gasoline was 2if per

In January of 1980, that tax amounted to an average of

7.5<f per gallon. By November of this year, the gasoline sales

tax is expected to be 10-12^ per gallon.

General Purpose Tax.

Unlike the 7i per gallon state excise tax,

sales tax on gasoline goes primarily into state, county and city

general funds for general purposes. Very little is used for

transportation or rapid transit.

Non-Competitive Tax. There are only 8 states we know of that have

a gasoline sales tax. California has the highest rate. When

compared to retail gasoline prices in the other western states,

California gasoline prices are substantially higher.

What Would Elimination of Gasoline Sales Tax Do?

-Reduce inflation

-Eliminate a tax on tax

-Reduce taxes and gasoline prices

-Reduce Government interference in our lives and businesses

-Put government on notice we will not be misled by their

"temporary taxes."

-Help gasoline retailers reclaim their white hats by forming a

mutually beneficial coalition between dealers and their customers.

IMMEDIATE RELEASE

Contact: Kalth Curry (213} 928*2541 or

Gary EIHs (213) 435*4873

4:

Oaiplta rtcord rains and iMfavonblt Motoring condftlonst about 30«000

Calffomlt^Jrivtrs alroac)/ ha|p tlgnod potltlons to support tho Abolish Gasollna

StiGi tax Inltltfvo within tht first throo vooks of the canpalgn.

Spearheaded by a Downoy gasoline station owner. Bill Pu1ey, and supported by

ililH^l^la service station ownets, the Association of California Car Clubs and

trucking groups, the Inltltlve would abolish the Six Percent Sales Tax added by the

State of California to all gasoline and diesel fuel sales. Ulth gasoline prices

predlcind to reach $2 by this sunner, according to petroleum expert Dan Lundberg,

e Pfterlst would save about 12 cents per gallon by abolishing the current Sales fax.

The Baseline Sales Tax alrea4y Is a double tax burden carried by California motorists.

Bteven cents ef Ux (seven ceits per gallon to the state) already is Included with

•ehb fallen of fhel purchased»v

The Assenbly recently dafeatet legislation which would have ellalnated a najor

•.V.V.

T.

PfvftW

th. UtallM S«lM Tw^teefuf.f «i1t ictlon tk. GuoIIm S«1m T«*

oMtliMM to b. iddod to ttM filwrall lAnd foryliB.

Tko MMllsk ewoIlM s«1«r Ti| iittitlvo vould olfirintto tko Six Porcont Solos

tM thoroky oadio, tfco Tox 0^.t

tutaj^clso Tox and tho Six

corrontly Mat onduro—tho

Tax. 1hU.0KHiii« alto .oold holt oMng tho

fastMt groiHng toxas In tho st>t» .awwiirtiy OM^nclotlng at a 40 percont Inflation

flfM.. Tho stato ostlMtos a 120 pglrwt IwMWn MXt yoar. ks OPEC continuos to

Inenoto charfot, tho solas tax also oscatlMod ^1s Mosnro also would ald.lndepondon

(HKollMl station ownors la bocoiriag aoro eaapatltlu* with nolghborlng statos.

1»

only tight stataa s«*Jocta4 to o gasollao salts Ux.

NTATIVE

^ABOLISH Gasoline

SALES TA^

11436 OLD RIVER SCHOOL ROAD,DOWNEY.CALIFORNIA 90241

(213)928-2541

1

March 14, 1980

Honorable Dominic Cortese

Santa Clara County

Board o£ Supervisors

70 West Hedding Street

San Jose, Calif. 95110

Dear Dom:

Please find enclosed copies of our Abolish Gasoline

Sales Tax petitions and other related information.

We would be grateful for your support and endorse

ment for this cause.

Very Truibr Yours,

Paul IT.'Hay

Co-Chairman

Abolish Gasoline Sales Tax Committee

PRH:pw

ABOLISH GASOLINE

BALLOT

INITIATIVE!

rm

11436 OLD RIVER SCHOOL ROAD, DOWNEY, CALIFORNIA 90241

(213)928-2541

FACT SHEET

Why Abolish Gasoline Sales Tax?

Regressive Tax.

Because sales tax is based on a percentage, it is

regressive and hurts most of those who can least afford to pay

it.

It is unrelated in any way to the ability to pay.

Inflationary Tax.

Because of OPEC price increases, gasoline sales

tax has increased at a rate 3 times that of the national infla

tion rate.

1979 inflation was 15.3^.

Gasoline sales tax

increased nearly 401.

Tax on Tax. Because federal (4^3 and state (Tif) excise taxes are

added to the cost before sales tax is collected, consumers are

p-aying tax on tax.

Undisclosed Tax.

While sales tax on all other taxable products is

shown separately from the product cost, California law requires

gasoline sales tax to be burried in the retail price. Many

motorists have been unaware they are paying sales tax on gasoline.

Essential Commodity Tax.

as is food.

Gasoline is an essential commodity just

Sales tax is not charged on other essential commod

ities, so why is it charged on gasoline?

Windfall Tax.

gallon.

In 1972 the approximate tax on gasoline was 2if per

In January of 1980, that tax amounted to an average of

7.5<f per gallon. By November of this year, the gasoline sales

tax is expected to be 10-12^ per gallon.

General Purpose Tax.

Unlike the 7i per gallon state excise tax,

sales tax on gasoline goes primarily into state, county and city

general funds for general purposes. Very little is used for

transportation or rapid transit.

Non-Competitive Tax. There are only 8 states we know of that have

a gasoline sales tax. California has the highest rate. When

compared to retail gasoline prices in the other western states,

California gasoline prices are substantially higher.

What Would Elimination of Gasoline Sales Tax Do?

-Reduce inflation

-Eliminate a tax on tax

-Reduce taxes and gasoline prices

-Reduce Government interference in our lives and businesses

-Put government on notice we will not be misled by their

"temporary taxes."

-Help gasoline retailers reclaim their white hats by forming a

mutually beneficial coalition between dealers and their customers.

IMMEDIATE RELEASE

Contact: Kalth Curry (213} 928*2541 or

Gary EIHs (213) 435*4873

4:

Oaiplta rtcord rains and iMfavonblt Motoring condftlonst about 30«000

Calffomlt^Jrivtrs alroac)/ ha|p tlgnod potltlons to support tho Abolish Gasollna

StiGi tax Inltltfvo within tht first throo vooks of the canpalgn.

Spearheaded by a Downoy gasoline station owner. Bill Pu1ey, and supported by

ililH^l^la service station ownets, the Association of California Car Clubs and

trucking groups, the Inltltlve would abolish the Six Percent Sales Tax added by the

State of California to all gasoline and diesel fuel sales. Ulth gasoline prices

predlcind to reach $2 by this sunner, according to petroleum expert Dan Lundberg,

e Pfterlst would save about 12 cents per gallon by abolishing the current Sales fax.

The Baseline Sales Tax alrea4y Is a double tax burden carried by California motorists.

Bteven cents ef Ux (seven ceits per gallon to the state) already is Included with

•ehb fallen of fhel purchased»v

The Assenbly recently dafeatet legislation which would have ellalnated a najor

•.V.V.

T.

PfvftW

th. UtallM S«lM Tw^teefuf.f «i1t ictlon tk. GuoIIm S«1m T«*

oMtliMM to b. iddod to ttM filwrall lAnd foryliB.

Tko MMllsk ewoIlM s«1«r Ti| iittitlvo vould olfirintto tko Six Porcont Solos

tM thoroky oadio, tfco Tox 0^.t

tutaj^clso Tox and tho Six

corrontly Mat onduro—tho

Tax. 1hU.0KHiii« alto .oold holt oMng tho

fastMt groiHng toxas In tho st>t» .awwiirtiy OM^nclotlng at a 40 percont Inflation

flfM.. Tho stato ostlMtos a 120 pglrwt IwMWn MXt yoar. ks OPEC continuos to

Inenoto charfot, tho solas tax also oscatlMod ^1s Mosnro also would ald.lndepondon

(HKollMl station ownors la bocoiriag aoro eaapatltlu* with nolghborlng statos.

1»

only tight stataa s«*Jocta4 to o gasollao salts Ux.

Document

Mr. Hay sent Supervisor Cortese a Letter regarding the Abolish Gasoline Sales Tax Petitions and Sought Supervisor Cortese's Support.

Initiative

Collection

Dominic L. Cortese

Content Type

Correspondence

Resource Type

Document

Date

03/14/1980

Decade

1980

District

District 2

Creator

Paul Hay

Language

English

City

Downey

Rights

No Copyright: http://rightsstatements.org/vocab/NoC-US/1.0/